are hoa fees tax deductible in florida

This deduction is only allowable for those who are self-employed. However this only applies if you are self-employed and.

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

HOA fees are tax deductible as a rental expense for homeowners who rent out the property in question according to guidance from HR Block.

. However if you live in the property yourself for some of the year such as in the case of a vacation property you can only deduct fees according to the percentage of time the house is a rental property. It is not tax-deductible if the home is your primary residence. Florida Statute Section 720301.

A homeowners association runs a community by imposing certain rules preserving its aesthetics and maintaining various aspects of the neighborhood. State and local tax deductions are capped at a combined total deduction of 10000 5000 if married filing separately. How Much are HOA Fees in Florida.

Generally your HOA fees are not tax deductible. Are HOA Fees Tax Deductible. If you are a land developer then it is deductible as a Sch C business expense.

At least the regular HOA dues do. Yes if you work from home then you can write off certain expenses related to your home office which includes HOA fees. HOA fees in Florida range from 100 to 350 depending on the community.

If you never occupy any part of your rental property yourself all of your HOA fees are tax-deductible. These fees are used to fund the associations maintenance and operations. If you claim 10 of your home is being used as your home office you can deduct 10 of your property taxes mortgage interest repairs and utilities.

HOA to elect IRC 528 status permits the association the flexibility to file Form 1120-H only when it produces a lower tax liability. Generally HOA dues are not tax deductible if you use your property as a home year-round. Whether or not your HOA fees are tax-deductible will depend on how the HOA spends the money.

This chapter of the Florida Statutes is known as the Homeowners Association Act. If most HOA fees are spent on common areas and amenities they are likely not tax-deductible. Though many costs of owning a timeshare are deductible on your income taxes including your mortgage interest and property taxes the IRS does not allow you to deduct HOA fees because they are considered an assessment by a private entity.

Homeowners who have a home office are allowed to claim a percentage of the fees that is proportional to the space occupied by the home office. In one instance a portion of the HOA fees are tax deductible. When comparing Florida retirement communities one thing everyone is anxious to get a handle on is what their HOA fees will be.

Expenses on a rental house depreciation repairs property taxes mortgage interest and HOA fees are 100 percent deductible against your rental income. Thats understandable because even though these fees wont be as high as things like your mortgage assuming you dont pay cash some people do of course or your property taxes they can amount to a decent. However if a significant portion of the HOA fees is used for insurance or property taxes they may be tax-deductible.

But there are some exceptions. No HOA fees are not tax deductible if the property is your primary residence. It provides for the rental business and expenses related to the basic upkeep of rental homes are business expenses.

Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. If you are working remotely for an employer these deductions do not apply. It does this with the help of HOA dues fees that the association collects from members.

You can also deduct 10 of your HOA fees. It is deductible but where is determined by how the land is being currently used. The amount deducted corresponds with the size of your home office.

In Florida HOAs that are required to file federal returns on Form 1120 or that elect to. Monthly HOA fees are tax-deductible when the HOA home is a rental house. Alternatively they can file the Florida Corporate Short Form Income Tax Return using Form F-1120A.

Are homeowners association fees tax deductible. An HOA or condo association that files a federal corporate return using Form 1120 must file a Florida Corporate IncomeFranchise Tax Return using Form F-1120. Yes you can deduct your property taxes off your tax return.

Are HOA Fees Deductible. In general you cannot deduct HOA fees from your taxes if the property is your primary residence. If the land is rented out as pasture for example the the HOA fees are a deductible as a Rental expense then.

They must file one of. Yes if you work from home then you can write off certain expenses related to your home office which includes HOA fees. For example if you occupy the home for 10 percent of the year you.

Keep your property tax bills and proof of payment. The short answer is no HOA fees are not tax deductible. In the rules of business expense tax exemptions HOA fees count.

The IRS considers HOA fees as a rental expense which means you can write them off from your taxes. If you use the house part of the. If you are a W-2 employee who is working remotely then this does not apply to you.

Sometimes HOA Board Members may increase HOA fees from 400 to 800 if there are amenities that need to be constructed such as a swimming pool clubhouse etc. Florida has no state personal income tax but the state has specific tax laws as it relates to HOAs. However this only applies if you are self-employed and choose to work from home.

The tax-preparing company does note however that if. What HOA Fees Cover. For example if the home office takes up 20 of your home you may claim 20 of the HOA fees on your taxes.

If you are self-employed and work primarily in your home you can deduct a part of your HOA fee through your home office deductions. Therefore if you use the home exclusively as a rental property you. You can reach HOA fees tax deductible status if you rent out your property either year-round or for a specific portion of the year.

However there are a few exceptions. HOA fees vary from one community to another and can either be very high or low. If the timeshare is a rental property however HOA fees do become deductible.

Are Hoa Fees Tax Deductible Here S What You Need To Know

Can I Write Off Hoa Fees On My Taxes

What You Need To Know About Hoas Homeowner Associations

Everything About Hoa Fees You Need To Know The Best Guide

Home Buying 101 Tax Benefits For Florida Homeowners

Are Hoa Fees Tax Deductible Experian

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Are Hoa Fees Tax Deductible Clark Simson Miller

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Can I Write Off Hoa Fees On My Taxes

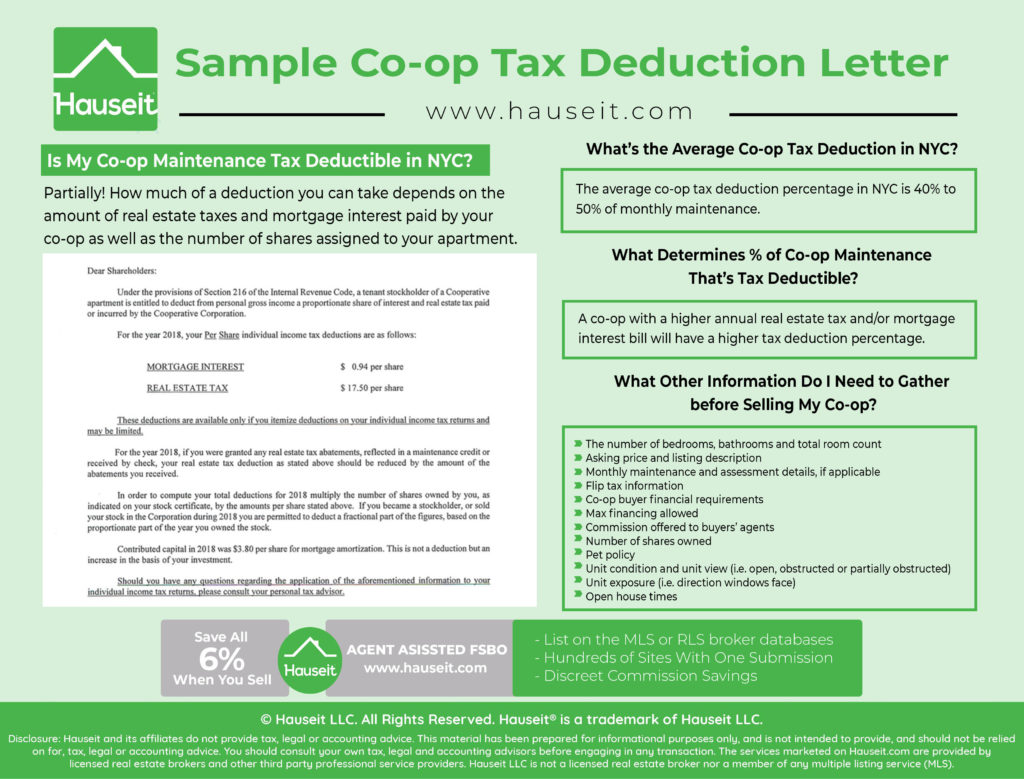

Sample Co Op Apartment Tax Deduction Letter For Nyc Hauseit

Are Hoa Fees Tax Deductible Clark Simson Miller

Are Homeowners Association Fees Tax Deductible

Are Hoa Fees Tax Deductible Clark Simson Miller

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

31 Tax Deductions Real Estate Investors Need To Know About Mynd Management